Spotlight

|

ARKHOS Netfusion Real Time Settlement Network creates a strong, secure, transparent distributive ledger, a revolutionary technique, that is not limited to any central authority in charge of a centralized system that coordinates valuable information.

|

Globlue has proudly become a member of the Hyperledger Project in order to collaborate with others technology world leaders in the process of accelerating the evolution of blockchain technology and its applications for government and private organizations. |

ARKHOS Netfusion Blockchain technology is trustless in the sense that it does not require third-party verification. It does not need a trusted third party (like a bank) to negotiate (exchange) value and instead uses powerful consensus mechanisms with cryptoeconomic incentives to verify the authenticity of transactions in the database.

The consensus mechanism makes the database safe (highly trustworthy) even in the presence of powerful or hostile third parties trying to manipulate the registry. For that reason, blockchain has been called ‘‘the single source of truth .’’ The trust element is important to the adoption of blockchain in tax compliance areas.

Using ARKHOS Netfusion to Collect Taxes and Send Invoices | Solving VAT Fraud Use Case

The use of blockchain technology to solve tax fraud has been discussed widely amongst leaders in the international community. At the World Economic Forum in Davos, Switzerland, January 20-23, 2016, more than 800 technology executives and observers were asked when they think governments will begin collecting taxes using blockchain. The average response was 2023, with 73 percent of respondents saying 2025. The European Commission is eager to adopt new technologies in fraud prevention and detection. More effective data sharing and adoption of sophisticated artificial intelligence (AI) programs is critical in that effort. Member states need new ways to share information to rapidly and more effectively identify and dismantle fraudulent networks. In that sense European Community VAT will be an early adopter, if not the earliest adopter, of blockchain, which will bring substantial efficiency to VAT collection and reduce costs and build trust in intergovernmental relationships. Most importantly, it will immediately end revenue losses of €50 billion to €60 billion per year in Missing Trader Intra-Community (MTIC) fraud.

Globlue Technologies has been part of important developments of a blockchain solution focused on real time tax collection for governments electronic payment systems, allowing for governance, transparency, compliance, while solving the tax fraud issue.

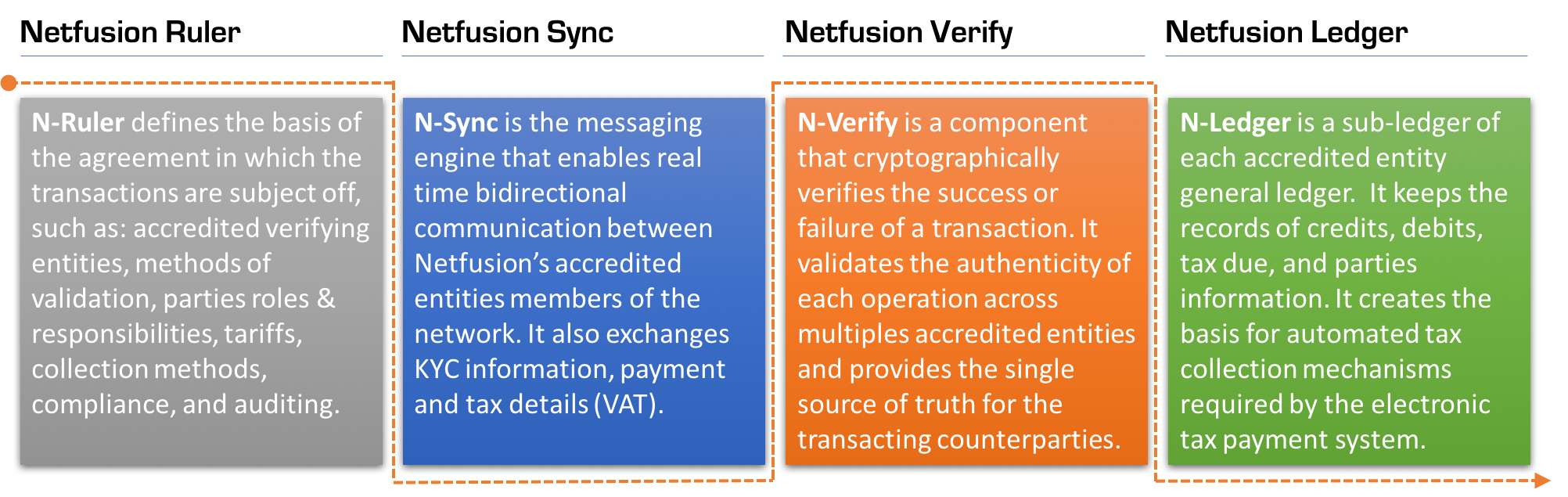

ARKHOS Netfusion components' orchestration provide the source of the truth across all steps of the process pertaining to taxable revenue calculation, smart contracts, payment responsibility, tax collection schedule, and automated reporting.

Globlue Technologies has been part of important developments of a blockchain solution focused on real time tax collection for governments electronic payment systems, allowing for governance, transparency, compliance, while solving the tax fraud issue.

ARKHOS Netfusion components' orchestration provide the source of the truth across all steps of the process pertaining to taxable revenue calculation, smart contracts, payment responsibility, tax collection schedule, and automated reporting.

|

Want to know more about ARKHOS Netfusion?

|