Insurance Companies need instant access to actionable intelligence in order to uncover and stop nefarious activities before they happen. The challenge that comes along with it is that SIUs are exposed to more data they can process in a timely fashion. Analysts have access to more data than ever. The practical application of performing advanced analytics over a large amount of data in a timely fashion, is very a challenging one.

ARKHOS Insights Key Features

- Continuous fraud monitoring of your incoming claims and policies

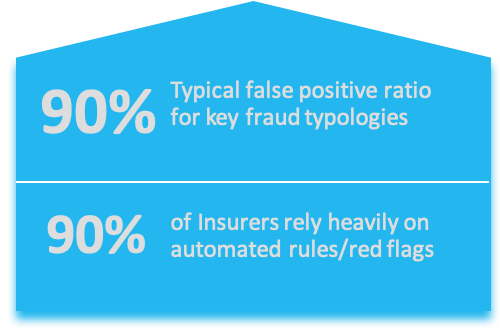

- Alert System allows the analyst to set alerts for results with minimal false positives

- Real-time research of internal claims and policy data

- Seamless real-time research on external sources such as NICB, OIG-DHHS, NPPES-NPI, TLOxp, Dow Jones, CLEAR, OpenCorporates and Whooster

- Identify entities from your own data with manipulated identities

- Attempt to develop alerts based upon known POIs

- Develop proactive research based upon key business points

- 360-degree entity summary on persons, organizations, vehicles, and transactions

ARKHOS' AI built-in engine continually scans all available data sources for suspicious patterns, identifies potential matches, and provides SIU analysts and investigators with alerts and insightful recommendations for optimized decisions.

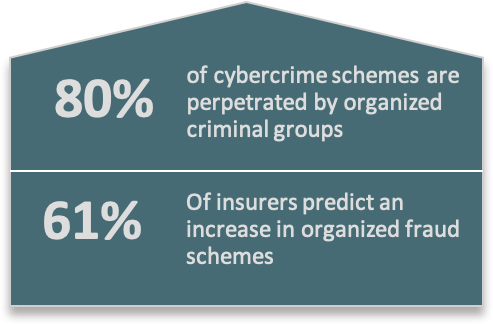

Converging forces are escalating fraud risk, exerting significant negative pressure on an organization’s bottom line.

ARKHOS Counter Fraud can help Insurance Companies to proactively fight insurance fraud by applying advanced analytics to streamline detection, reduce false positives, and increase efficiency.

Try ARKHOSContact our Counter Fraud team for a Demo!

|

Read White Paper

|